Microfluidic devices market report

Yole Développement has released its technology and market analysis, ‘Microfluidic applications in the pharmaceutical, life sciences, in vitro diagnostic and medical device markets’. The report analyses and investigates events of the last three years, consolidating market data from 2010-2012 and providing forecasts for 2013-2018.

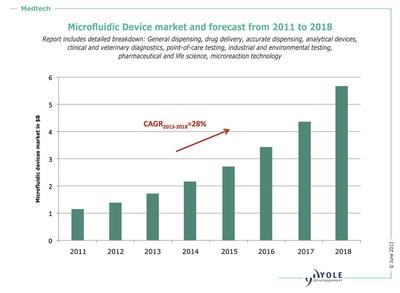

Benjamin Roussel, Technology & Market Analyst, Microfluidics & Medical Technologies at Yole Développement, says the microfluidic device market will “grow swiftly, from $1.4bn in 2013 to $5.7bn by 2018.” According to him, “This impressive 27% growth will be fuelled mainly by pharmaceutical research and point-of-care applications.”

Yole Développement outlines how the healthcare industry is moving toward personalised medicine. The line between traditional markets (pharmaceutical and in vitro diagnostic markets) has blurred as rapid, accurate tests are needed to increase pharmaceutical research yield and better treat patients. By offering innovative solutions, microfluidic technologies have managed to fill the gap.

Microfluidic devices can be produced either by pure microfluidic fabs or in-house by fully integrated players. The report reveals the top 15 pure microfluidic fab players and looks at the ‘hidden’ market linked to in-house production. The distinction between the microfluidic device market (first-level package device) and the microfluidic technology-based test market has also been calculated.

Nine segments

Today, microfluidic devices are widely accepted in several applications. Nevertheless, the advantages and motivations for adopting microfluidic technologies are highly dependent on the targeted application. For example, the added value of microfluidic devices in point-of-care applications depends on the associated small volume of necessary reagents, low-cost disposables and high sensibility. The advantages for pharmaceutical research applications are to allow process automation and multiplexed assays.

The report provides a market segmentation covering the following applications:

- General dispensing

- Drug delivery

- Accurate dispensing

- Analytical devices

- Clinical and veterinary diagnostics

- Point-of-care testing

- Industrial and environmental testing

- Pharmaceutical and life science

- Microreaction technology

Each application is presented with market data, trends/drivers, key players and technologies used.

Changes in the material mix

Different materials are used to manufacture microfluidic devices: glass, polymer, silicon, metal and ceramics.

Whereas polymer is becoming the reference substrate for point-of-care applications, glass is still the main substrate for analytical devices. The penetration rate of each substrate vs microfluidic application is presented in the report.

Recently, the material mix has changed due to:

- the need to reduce device cost for some applications (ie, switching from glass to polymer)

- the need to add new on-chip functions linked to emerging applications (ie, growth of silicon use)

Material mix changes present opportunities for new players entering the microfluidic market - for example, the high growth rate of next-generation sequencing technologies is opening new doors for silicon players. The report provides an analysis of these opportunities in line with material mix changes.

Optics11 Life appoints Jacquelien ten Dam as CEO

Optics11 Life plans to accelerate its commercial growth in key markets while building strategic...

Epilepsy pioneer elected President of Aust Academy of Science

Laureate Professor Sam Berkovic — one of the world's most respected neurologists...

CSIRO announces 300+ job cuts as part of restructure

CSIRO will need to reduce roles in its Research Units by 300–350 full-time equivalent staff...